If so, you could be wondering tips on how to open and find the best UK banks for non-residents. In addition to the FSCS, the accounts are safeguarded by the UK Fee Services Laws 2017, offering supplementary protections for banking operations. To keep your account in good standing, ensure common legitimate exercise. Banks could freeze or shut dormant accounts, so make common transactions even if you’re not actively using the account for day-to-day operations.

- If you’ve further questions you would like answered, don’t hesitate to get in contact with us immediately.

- Contemplate reserving a consultation with banking specialists who can guide you through the most appropriate choices for your specific state of affairs and business wants.

- Revolut US provides a Standard account plan which has no month-to-month expenses to pay, plus alternate options which have more options and charges as a lot as 16.ninety nine USD/month.

- Examine out our important guide on the means to open a bank account in Andorra as a British expat, including paperwork, fees, banks and much more.

- Usually the documents needed embody proof of address, proof of ID , employment and revenue details and your tax ID.

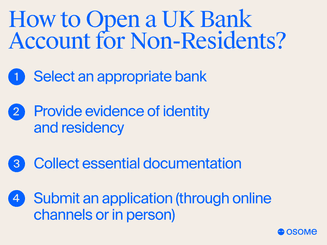

- When opening a checking account in another country, extensive documentation is needed to authenticate foreigners.

On the opposite hand, Barclays International offers varied companies, including mortgages, investments, overseas forex savings accounts, and other banking services. If you’re not a resident of the UK, with a proof of tackle and the legal right to live within the country, you may wrestle to walk into a excessive road bank and open an account. That’s because most main UK banks are set as much as cater to local residents firstly. If you don’t have an area UK residential tackle you could still be succesful of personal bank account dubai open an account to hold GBP – however the financial institution is prone to ship you to its international or expat banking division. International and expat banking services are sometimes arrange for prime wealth individuals investing in multiple currencies, and can have high charges and a excessive minimum steadiness requirement to qualify. The major sort of non-resident account in Europe comes from the worldwide and expat banking arms of major international banks, like HSBC.

International Workplaces

For instance, If you’re studying in the UK, a letter from your college confirming your handle may work. You can use your passport, id card, or driving license (if you’re from the EU). When you want to open an account with a serious bank, whether in particular person or on-line, you’ll must show who you are and where you live. Two UK banks which will Assistance in Opening a Bank Account in the UK for Individuals settle for non citizens and non residents are Barclay’s and Commonplace Financial Institution. You can just stroll up to nearly any bank and most of them will take you.

Choose The Path In Your Financial Journey In The Us

With its presence in over 200 nations and support for more than 30 currencies, Revolut provides you with a Euro bank account and world banking answer. By deciding on the proper UK bank account, you achieve the benefit of environment friendly monetary management, entry to a robust banking infrastructure, and the peace of thoughts of partnering with reputable establishments. To higher allow you to, here are the most effective banks to open an account in the UK. UK banks offer a diverse selection of services tailored to fulfill the needs of non-residents.

What If I Don’t Have Proof Of Address?

A specialist on-line service like Clever or Revolut may properly be https://execdubai.com/ a greater wager. Specialist options will usually supply a better total deal, together with a extra simple verification course of, decrease fees and higher change rates. You additionally won’t need to fret about restrictive minimal balance necessities or proving your income to get your account set up. European residents can easily open an account with no month-to-month charge – however, for non-residents this can be a little trickier. You’ll normally have to maintain a excessive minimal deposit amount to qualify for a fee waiver. Each providers provide accounts which don’t have any ongoing or maintenance costs, so you can select to pay only for the companies you want to use.

What’s extra, Sensible, Revolut and Monese don’t require proof of UK residency to open an account – which you can do quickly and simply online. If you need a GBP account for tourism, attempt alternative providers like Clever and Revolut which provide accounts with GBP providers for folks living in many different countries. To open a selected non-resident account with a global banking service you’re likely to have to be over 18, and show you have a legitimate purpose for needing the account.